Grow General Tool and advance our clusters

The first of our actionable components is to grow our General Tool business and advance our proven clustered market approach to meet demand and enable increased rental penetration in North America. In the UK, our focus is on optimising our operational network. We are focused on achieving operational improvements in existing locations, exploiting latent capacity in newly opened locations, investing in fleet, leveraging the economics of our cluster approach and improving rental rates.

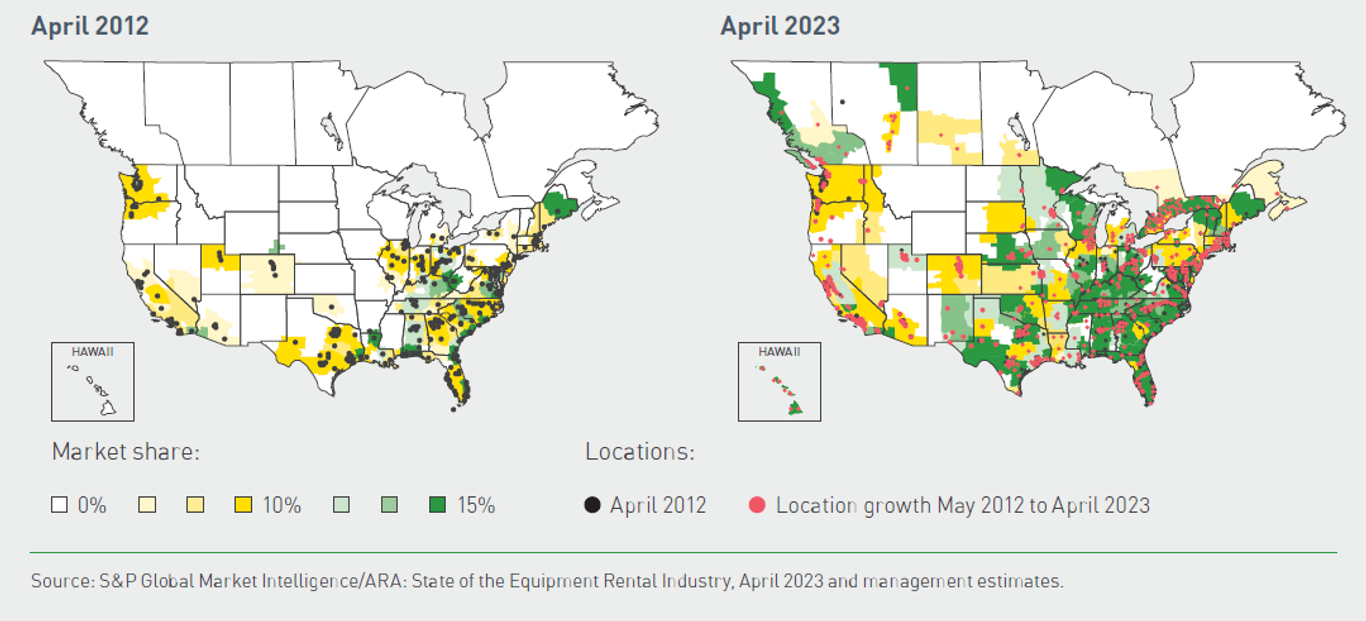

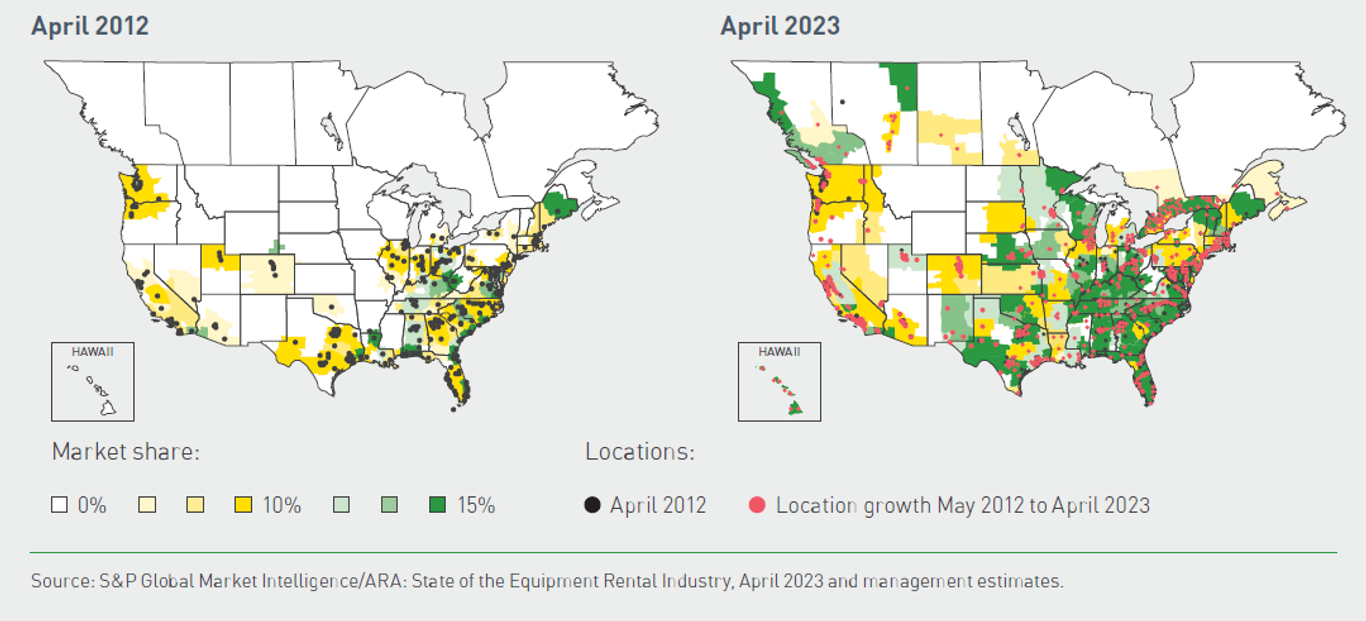

Our plan included 126 General Tool greenfield locations whose location was determined based on our experience and analytics down to the zip code level. This analysis includes our assessment of current market share, fleet per capita, customer statistics, construction starts, proximity to existing locations, square footage under roof and the competitive landscape. Our greenfield openings are biased towards the western part of the US where we have lower market share. This organic growth strategy is being complemented by bolt-ons.

Our plans during Sunbelt 3.0 for Canada involve bringing our market share to our 2021 US level through 26 greenfield openings, across all provinces and advancing our clusters around Toronto which is the largest rental market. When we entered the Canadian market in 2014 we acquired six locations in Western Canada. At April 2023 we had 73 General Tool locations and 119 locations in total.

There is a drag on margins when we open new stores but generally they improve quickly as they deliver more revenue and broaden the fleet and customer mix. The same happens with acquisitions because we buy businesses we can improve, either operationally or through additional investment, or both. Even when the market declines, as was the case in 2020/21, our stores can continue to benefit from the structural part of the growth which is independent of the market. The strength of our brand and reputation means that greenfield sites become profitable very quickly. The diversity of our product portfolio and services only adds to this.

Structural growth is people choosing to rent more equipment (increased rental penetration) and the big getting bigger (increased market share). We are able to keep growing because we prioritise investment in the fleet and have the financial strength to do that. Our customers want good quality fleet, readily available to meet their needs. Investing in a broad range of fleet and backing that up with great service means our customers remain loyal and do not need to look elsewhere. Prioritising higher return on investment (‘RoI’) products further helps our growth.

Our cluster approach

Our cluster approach is an important aspect of our strategy. Our greenfield sites are chosen to enhance our existing business. We focus on building clusters of stores because, as they mature, they access a broader range of markets unrelated to construction leading to better margins and RoI. The size and composition of a cluster depends on the market size based on Designated Market Areas.

A top 25 market cluster in the US has more than 15 stores, a top 26-50 market cluster more than ten stores and a top 51-100 market more than four stores. We also include the smaller 101-210 markets within our cluster analysis. We have found that these smaller markets, while performing less well than others overall, often prove more resilient when times are less good. Our definition of a cluster in these markets is two or more stores. Creating clusters is also a key element of our expansion strategy in Canada which also helps us increase the Specialty business element of what we can provide for customers. With the advanced technology we have in place, we are able to analyse local market data accurately. This allows us to find similarities between certain US and Canadian centres, and model our growth plans accordingly. The more customers get to know and trust us, the faster we are able to grow.

We focus on ensuring our clusters meet the multiple needs of local customers even if that means some stores may appear superficially to perform less well than others. The interaction of the stores in a cluster is what gives us real competitive advantage. We find that having a blend of locations is highly desirable and we like to mix up the large equipment locations with smaller General Tool stores. The addition of Specialty stores serves to differentiate us from competitors in the area. This enables us to broaden and diversify our customer base and our end markets, as we extend our reach within a market. Average revenue per store is not a relevant measure with which to evaluate the success of individual clusters or even the business as a whole. The value is in the mix.

Amplify Specialty

The second of our actionable components is to drive accelerated growth through recently realised Specialty scale, unique cross-selling capabilities, and rental penetration.

Advancing technology

The third of our actionable components is making the move from industry-leading technology platform, to a leader among the broader industrial and service sector; further improving our customer value proposition and capture the benefits of scale across the Group.